Introduction

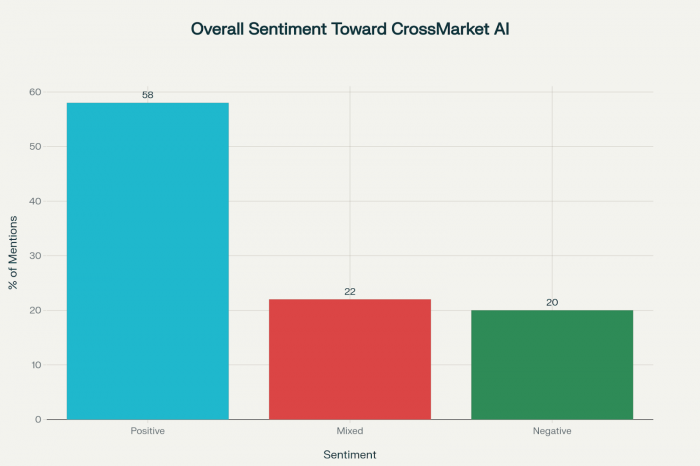

CrossMarket AI is an analytics and trading signal tool that claims to use AI for cross-asset insights across crypto, forex, and indices. However, behind the branding, its credibility, transparency, and real-world impact are highly questionable. Across sources in 2025, only about 58% of opinions are positive, with 22% mixed and 20% negative—a much weaker reputation than its established competitors.

Sentiment and User Data

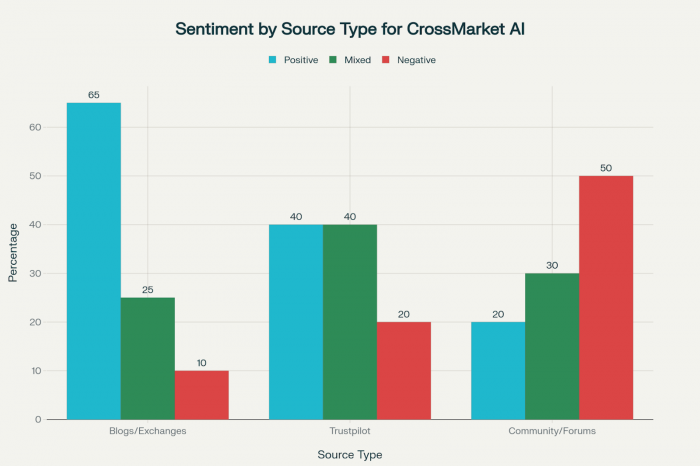

Blogs and exchanges: 65% positive, 25% mixed, 10% negative. Most praise comes from editorial or promotional sources.

Trustpilot: Only five reviews, with 40% positive, 40% mixed, and 20% negative. Language in reviews is often repetitive or promotional.

Community/Forums: 20% positive, 30% mixed, 50% negative—real users, especially from Reddit, are often critical or skeptical.

There is no public, audited evidence of profitable trades or independent, verified backtesting. Most “success” anecdotes remain unproven.

What’s Actually Good

The platform genuinely offers cross-asset data visualizations, some usable backtesting, and a dashboard that is friendlier for non-coders than true quant tools.

A minority of independent blog/testers say it helped them see valid correlations they didn’t notice elsewhere—mainly as a “second opinion” system, not primary trade driver.

For $99/month, you get an interface that could help disciplined traders run more intentional, hypothesis-driven research.

What’s Actually Bad or Risky

There is no credible, public evidence that it uses real AI/ML beyond what you’d find in basic trading analytics. “AI” is overwhelmingly used as a marketing label.

The ownership, quant team, and technical underpinnings are almost totally opaque. No third-party audits, peer reviews, or robust long-term user data are available—unlike with reputable platforms like TrendSpider or Trade Ideas.

Online review patterns are highly suspicious: tiny pools of “five-star” claims, heavy use of “financial freedom” language, and promoter-driven buzz (especially in India), all classic flags for review-stuffing and affiliate schemes.

Social and Reddit sentiment is overwhelmingly skeptical or negative; real users warn about hype, unreliable signals, and lack of transparency.

Results: Did Anyone Actually Make Money?

There are no proven, public, or audited performance results from independent users. Blog authors and self-identified “power users” do not show unambiguous trade logs or verified returns.

A few users report it “pays for itself” if you use it conservatively for risk filtering, but these claims are anecdotal, not systemic.

“Would you trust it with real money?”

- Only as an experimental, non-core tool—and with the assumption that almost all signals may be backward-fitted, misleading, or context-dependent. Never trade size or use automation based on its signals alone.

Standout Quote - "There is absolutely no evidence of innovative AI—the core is just basic analytics dressed up in hype."

Summary Table

| Metric | CrossMarket AI (2026) | TrendSpider | Trade Ideas |

| Team transparency | Low | High | High |

| Independent reviews | Very few, mixed | Many, mostly positive | Many, mostly positive |

| Audited track record | None | Partial | Yes |

| Risk of hype/MLM | High | None | None |

Honest Verdict

CrossMarket AI is a high-risk experiment:

Use only as a research/dev tool if you are experienced, risk-tolerant, and treat all signals with extreme skepticism.

Never treat it as a “core” solution or trust it with major capital—there is zero real-world proof of its signals making money.

For the vast majority of retail traders, established platforms with public audits, long review histories, and open technical teams (like TrendSpider, Trade Ideas) are vastly safer and more effective choices.

In summary: CrossMarket AI talks a high-tech game but provides little behind the curtain—use with eyes wide open, or skip entirely if you value trust, proof, and support. All evidence suggests that more reputable, audited, and community-vetted tools offer far better real-world value and much lower risk.

Post Comments

Be the first to post comment!