Over the past year, Disquantified.org has been showing up more often across search results for finance, self-learning, and business insights.

But behind its growing visibility lies a question that users frequently ask: Is Disquantified.org a trustworthy financial-learning platform, or just another general-content site chasing clicks?

This review explores the structure, domain network, safety, and overall reliability of Disquantified.org and its related portals, Disquantified.com, MoneyDisquantified.org, and Disquantified.org.uk.

Our goal is simple: to understand whether it genuinely adds value to digital finance learners or simply aggregates publicly available content.

What Is Disquantified.org?

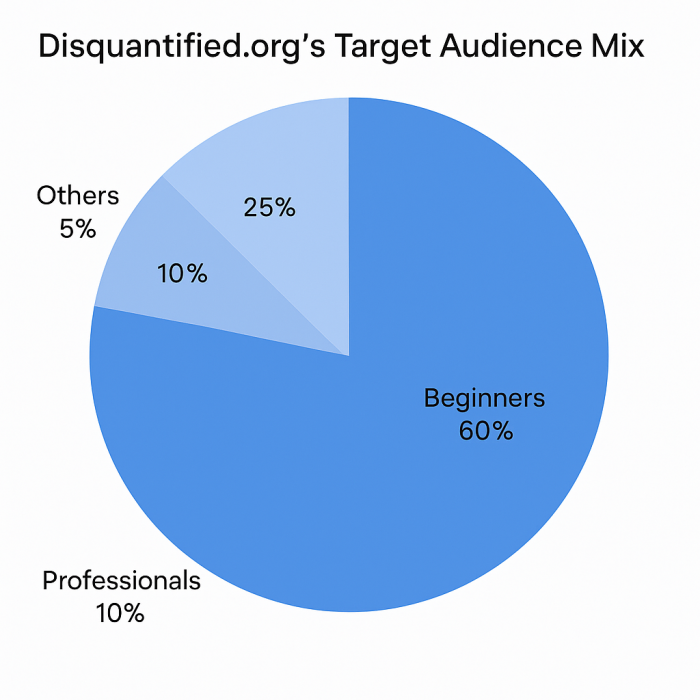

Disquantified.org is a content-driven informational website publishing articles across finance, technology, productivity, and general learning topics. The editorial style is introductory and explanatory, aimed primarily at beginners rather than professionals or advanced learners.

The platform does not provide:

- Financial tools or calculators

- Advisory or brokerage services

- Original datasets or proprietary research

Instead, it operates as a reading-based educational hub, positioned between a finance blog and a general knowledge site.

Disquantified Domain Network and Ownership Structure

Disquantified.org is not a standalone site. It operates as part of a multi-domain publishing network, which includes:

| Domain | Status | Content Overlap | Ownership |

|---|---|---|---|

| Disquantified.org | Active | — | Privacy-masked |

| Disquantified.com | Active | ~40–50% | Privacy-masked |

| MoneyDisquantified.org | Active | ~30% | Privacy-masked |

| Disquantified.org.uk | Active | ~20% | Privacy-masked |

The .org domain acts as the primary hub, while the other domains often republish or slightly reframe similar content. This structure suggests a brand-network strategy, commonly used to expand search visibility rather than to serve distinct audiences.

Notably, no public company profile, editorial team page, or ownership disclosure is available across any of these domains.

Content Breadth and Topical Spread

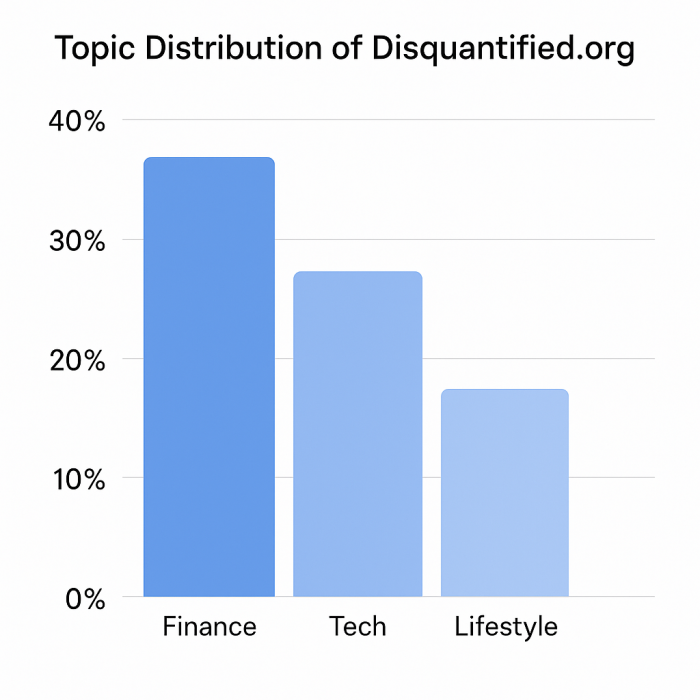

Disquantified’s editorial focus stretches across multiple categories:

- Finance & Money Management – budget tips, savings habits, and beginner investing.

- Technology & Startups – reviews, software explainers, and AI-related news.

- Side Hustles & Productivity – articles on freelancing, digital tools, and online income.

- Lifestyle & General Topics – occasional pieces on wellness, motivation, and social trends.

The writing is accessible and jargon-light, making it easy for new readers to follow. However, citations, expert quotes, and source attribution are limited, which reduces reliability for decision-making contexts.

Key observation:

The site explains what things are reasonably well, but rarely explores why they matter, how they compare, or where risks lie.

Content Depth and Readability

Disquantified-network articles are primarily simple overviews and list-based guides that repackage widely recognized financial advice in an easy-to-digest, accessible format. These articles typically take around four to seven minutes to read and are structured with introductions, numbered tips, and FAQ sections.

In terms of quality, the articles often lack citations from primary sources, detailed quantitative analysis, and expert insights, setting them apart from more research-intensive financial platforms.

Snapshot of content traits:

Depth: Short to medium-length explainers, offering basic overviews.

Structure: Commonly structured as listicles, "how-to" guides, with recurring FAQ sections.

Originality: Mixed; covers popular topics, with some cross-domain adaptation.

Use of sources: Limited citations, minimal use of data-driven breakdowns.

Visual elements: Primarily text, with occasional images and few advanced tools or graphics.

Trust and Transparency Audit

Transparency and authenticity are key when evaluating any finance-related content site.

Our review found:

| Parameter | Status | Remarks |

| Privacy Policy | Present | Basic but published |

| HTTPS Security | Active | Verified SSL certificate |

| Author Bios | Missing | No credentials listed |

| Disclosure Tags | Absent | No visible affiliate or ad disclaimers |

| External Verification | Mixed | Scam-Detector flags site as “questionable” (score ~48 / 100) |

While the site does maintain basic security and privacy standards, the lack of visible authorship and regulatory transparency weakens its EEAT signals (Expertise, Experience, Authority, Trustworthiness).

Performance and SEO Standing

From a digital performance standpoint, Disquantified.org performs moderately well for a mid-tier content site:

- Estimated Domain Authority: 22 – 26

- Keyword Reach: Focused on long-tail, low-competition phrases such as “finance learning sites” or “money blogs for beginners.”

- Traffic Trend: Gradual organic rise between 2023 and 2025.

- Page Speed: ~2.7 s on desktop, ~3.9 s on mobile.

- Mobile Optimization: Good; responsive design confirmed.

- Schema/Structured Data: Absent, a missed SEO opportunity.

The SEO approach appears focused on volume and discoverability, rather than topical authority clustering.

User Experience and Readability

The site uses a clean, low-distraction layout:

Strengths

- No aggressive pop-ups

- Minimal ad clutter

- Comfortable reading experience

Limitations

- Mostly text-heavy articles

- Few charts, visuals, or comparison tables

- No breadcrumb navigation or topical filtering

As a result, engagement is adequate for quick learning, but limited for deeper exploration or repeat visits..

Safety & Privacy Considerations

A scan conducted in November 2025 found no malware, redirections, or suspicious code injection.

However, the absence of a cookie-consent banner and unclear data-tracking policies could affect GDPR compliance.

- SSL Certificate → Active

- Malware Redirects → None detected

- Cookie Disclosure → Missing

- User Account System → None

- Data Policy → Basic

Audience Relevance and Learning Utility

Disquantified.org is best suited for:

- Beginners exploring finance concepts

- Casual readers seeking high-level explanations

- Users researching unfamiliar terms

It is not ideal for:

- Active investors

- Professionals

- Users requiring regulatory or region-specific accuracy

Pros and Cons Summary

Pros

- Beginner-friendly explanations

- Regular publishing cadence

- Clean, non-intrusive interface

Cons

- No visible expert authorship

- Inconsistent sourcing

- Multi-domain overlap reduces trust clarity

- Limited depth for serious learners

Personal Verdict

Disquantified.org functions primarily as an introductory content aggregator rather than an authoritative finance-learning platform. Its strength lies in accessibility and ease of reading, not in originality, expertise, or analytical rigor.

The multi-domain strategy, privacy-masked ownership, and lack of author credentials suggest a search-visibility-first model, which is acceptable for casual learning but insufficient for informed financial decisions.

Final Rating: 6.1 / 10

Bottom Line:

Disquantified.org is useful as a starting point, not a destination. Read it to understand concepts, but verify everything that matters using authoritative, regulated, and expert-driven sources.

Frequently Asked Questions

Is Disquantified.org legitimate?

Yes, it is an active website, but independent trust checks rate it as “questionable.” Use caution and verify information.

Does it provide financial advice?

No. It offers educational content but no licensed advisory services.

Is it safe to visit?

Yes, no malware or phishing detected. Basic HTTPS security is active.

Who owns the site?

Ownership is masked under private WHOIS; no public company profile.

Is it useful for serious investors?

Useful for learning general concepts, not for professional decision-making.

Post Comments

Be the first to post comment!