Financial news websites play a critical role in shaping how readers understand markets, investing, technology, and risk. When a platform positions itself at the intersection of finance and technology, readers often assume a higher level of analytical rigor, editorial oversight, and accountability.

FintechZoom.com presents itself as one such platform. On the surface, it resembles a modern financial publication. A deeper look, however, reveals a mixed editorial identity, part newsroom, part content aggregator, part thought-leadership hub,m raising important questions about authority, consistency, and intent.

This article examines FintechZoom.com as a media product, not as a service or brand endorsement.

First-Layer Observation: What the Website Is Trying to Be

FintechZoom.com visually and structurally resembles a digital financial magazine. Its navigation and taxonomy suggest coverage across:

- Markets and indices

- Banking and payments

- Crypto and digital assets

- Business and software

- Gaming and entertainment

- Lifestyle-adjacent finance topics

This breadth signals an ambition to act as a generalist financial information hub, similar in layout (but not necessarily depth) to mainstream finance portals.

However, broad coverage alone does not establish authority. The real signals come from how content is produced, framed, and disclosed.

Content Scope vs Content Depth

Breadth Is High

The site publishes frequently across many verticals. Based on visible listings:

- Some articles are time-sensitive (market trends, fintech developments)

- Others are evergreen explainers (banking systems, investment tips)

- Some drift into loosely connected areas (gaming mechanics, entertainment-adjacent finance)

This wide net helps capture search traffic, but it also dilutes topical specialization.

Depth Is Uneven

A consistent pattern emerges across articles:

- Topics are introduced clearly but explored at a high level

- Arguments rely more on narrative explanation than on original data

- Articles often summarize trends rather than analyze primary sources

- Technical or regulatory claims are rarely supported with citations

This suggests the content is designed to be accessible, not authoritative.

Editorial Structure: What’s Missing Matters More Than What’s Present

One of the most telling aspects of FintechZoom.com is what is not visible.

No Transparent Editorial Ownership

From observable pages:

- No clearly listed editorial board

- No named editors responsible for specific beats

- No public editorial standards or methodology page

In financial publishing, especially under Google’s YMYL (Your Money, Your Life) standards, this absence weakens trust.

Author Identity and Expertise Signals

Articles appear to be published without consistent author attribution or with generic bylines. This creates several issues:

- Readers cannot assess subject-matter expertise

- Accountability for errors or bias is unclear

- EEAT (Experience, Expertise, Authoritativeness, Trustworthiness) signals are weak

This does not mean the content is wrong, but it does mean readers are asked to trust the platform itself, rather than identifiable experts.

Category Design and SEO Intent

FintechZoom’s category structure reveals strong search-engine optimization intent:

- Categories align with high-volume keywords (Fintech, Crypto, Banking, Gaming)

- Article titles are descriptive and trend-focused

- Content is updated frequently to maintain freshness

This approach is common among content-driven finance portals, but it often prioritizes reach over rigor.

There is little evidence of:

- Original reporting

- Proprietary datasets

- Exclusive interviews

- Deep investigative journalism

The Disclaimer Tells an Important Story

FintechZoom includes a prominent disclaimer stating:

- Content is for informational purposes only

- It is not investment or financial advice

- The site does not endorse specific products

- Readers must conduct their own research

While this is legally prudent, it also signals that the platform is positioning itself as an information distributor, not an advisory or analytical authority.

In practice, this places responsibility almost entirely on the reader.

Mixed Identity: Media Platform vs Consulting Presence

An interesting observation is the presence of strategic consulting pages alongside editorial content.

This introduces potential role ambiguity:

- Is the site a neutral publisher?

- Or a thought-leadership channel supporting consulting services?

When editorial content and business services coexist without clear separation, readers may struggle to distinguish:

- Independent analysis

- Brand positioning

- Lead-generation content

There is no explicit conflict disclosure clarifying this boundary.

Tone Analysis: Neutral, But Not Critical

FintechZoom’s writing tone is generally:

- Polite

- Optimistic

- Explanatory

What’s largely missing:

- Strong counter-arguments

- Risk-heavy framing

- Critical examination of claims

- Explicit uncertainty modeling

This makes the content easy to read, but also low-friction, which can be problematic in finance where skepticism is essential.

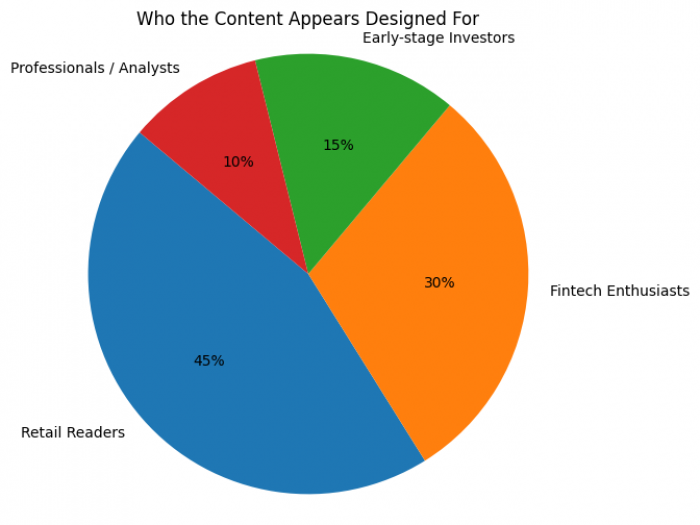

Who the Content Appears Designed For

Based on structure and language, FintechZoom seems aimed at:

- Curious retail readers

- Early-stage investors

- Fintech enthusiasts

- Non-technical audiences

It does not appear optimized for:

- Professional analysts

- Institutional investors

- Regulatory specialists

- Deep technical audiences

This positioning is not wrong, but it should be recognized.

Trust Assessment: Strengths and Limitations

Strengths

- Clean, modern layout

- Broad topical coverage

- Regular publishing cadence

- Clear disclaimers

Limitations

- Weak author transparency

- No visible editorial governance

- Inconsistent analytical depth

- SEO-driven topic selection

Blurred line between content and services

Practical Reading Guidance

FintechZoom.com works best when used as:

- A starting point for understanding topics

- A trend-awareness source, not a decision engine

- A supplementary read, not a primary authority

It should not be used as:

- Sole input for investment decisions

- Legal or regulatory guidance

- Technical implementation reference

Final Assessment

FintechZoom.com occupies a middle ground in the financial content ecosystem.

It is not a scam, and it does provide accessible explanations of complex topics. However, it also does not meet the standards of a high-authority financial publication in terms of transparency, authorship, or analytical rigor.

In essence, FintechZoom is best understood as a content aggregation and interpretation platform, not a source of original financial insight.

Readers who approach it with that expectation are unlikely to be misled. Readers who assume institutional-grade analysis may be disappointed.

Post Comments

Be the first to post comment!

Table of Content

- First-Layer Observation: What the Website Is Trying to Be

- Content Scope vs Content Depth

- Editorial Structure: What’s Missing Matters More Than What’s Present

- Category Design and SEO Intent

- The Disclaimer Tells an Important Story

- Mixed Identity: Media Platform vs Consulting Presence

- Tone Analysis: Neutral, But Not Critical

- Who the Content Appears Designed For

- Trust Assessment: Strengths and Limitations

- Practical Reading Guidance

- Final Assessment

- Comments

- Related Articles