Businesses that operate in high risk industries often struggle to secure a payment processor that will approve their applications and allow them to accept credit card transactions without long delays. Most traditional processors avoid working with merchants who have higher chargeback exposure or unique regulatory requirements. This is where the high risk merchant account at highriskpay.com becomes attractive to owners who need fast approval and a flexible underwriting approach.

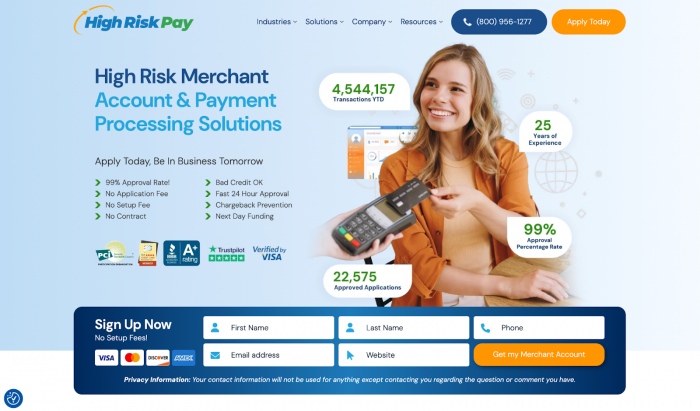

HighRiskPay.com positions itself as a provider that focuses specifically on companies that mainstream processors decline. The service claims to offer simple onboarding, a 99 percent approval rate, and access to tools that help merchants manage payments and reduce fraud risks. This review takes a closer look at how the service operates, which features stand out, and what type of business will benefit the most.

What HighRiskPay.com Offers to High Risk Merchants

The company supports a broad range of industries that are historically difficult to place with standard payment processors. These include adult services, CBD, travel, credit repair, firearms, subscription based businesses, nutraceutical products, online pharmacies, and other categories that often face compliance hurdles. By partnering with banks that accept such industries, the provider creates a pathway for merchants who need credit card acceptance to stay competitive.

HighRiskPay.com advertises fast approvals, sometimes within twenty four to forty eight hours, depending on the quality of the documents submitted. They also offer features such as virtual terminals, mobile payment options, eCommerce gateways, recurring billing support, and fraud prevention tools. These services are commonly needed by high risk merchants who depend on secure and predictable payment workflows.

The company also states that it does not charge setup fees or long term contract fees. This can be helpful for new businesses that are still managing startup costs.

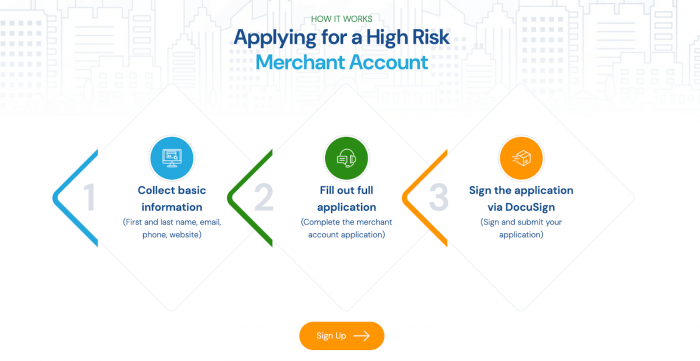

How the Application Process Works

Applying for a high risk merchant account at highriskpay.com begins with a short intake form where the merchant submits basic details like name, phone number, email address, and website. After the initial review, the merchant receives a full application packet that must be completed and signed. The company uses electronic signature systems to speed up document processing.

Approval is not based solely on credit scores. Instead, the review process considers industry experience, business model structure, website completeness, refund policies, and the merchant’s previous processing history if available. This makes HighRiskPay.com accessible to owners who have been rejected by traditional processors because of low credit or limited history.

Once approved, merchants can begin accepting payments through gateways, terminals, or online integrations that connect to common platforms.

Features That Matter the Most

HighRiskPay.com markets several features that specifically support the needs of high risk merchants. These include fraud screening, chargeback alerts, data encryption, detailed reporting, and next day funding for eligible accounts. These tools aim to reduce the risk of payment disputes while giving merchants a clearer view of their transaction patterns.

Since many high risk merchants experience frequent chargebacks, the availability of prevention tools is an important part of the service. Merchants can also access customer support by phone or email, which is useful during onboarding or when adjusting transaction limits.

Comparison Table: HighRiskPay.com and Other Providers

The following table provides a simplified comparison based on public information you supplied. It shows how HighRiskPay.com aligns with other major high risk providers.

Table 1. Comparison of High Risk Merchant Account Providers

| Provider | Approval Speed | Support for Very High Risk Industries | Monthly Fees | Key Advantage |

| HighRiskPay.com | 24 to 48 hours | Wide coverage including adult, CBD, bail bonds, and travel | Minimum monthly fee but no setup cost | Very fast approval for difficult categories |

| PaymentCloud | 1 to 2 days | Broad risk categories including MATCH list accounts | Monthly platform fees apply | Strong integrations for growing merchants |

| PayKings | Varies | Extensive high risk specialization | Varies by plan | Deep industry knowledge and flexible placement |

| Durango | 1 to 3 days | Suitable for very high risk and offshore needs | Varies | Known for advanced risk handling |

From this comparison, HighRiskPay.com stands out for its rapid approval and willingness to work with industries that mainstream processors avoid. Merchants who need immediate activation often choose this provider for speed.

Who Should Consider HighRiskPay.com

The service is suitable for merchants who want fast approval and a straightforward processing setup. Businesses that have been declined by PayPal, Stripe, or Square may find this provider more flexible. It is also a solid option for owners who work in regulated or sensitive categories where additional documentation is required.

However, merchants who need detailed dashboards, real time chargeback analytics, or advanced fraud modeling may find that other providers offer more sophisticated tools. As with any financial service, it is important to ask for a complete fee schedule before signing. Transaction fees for high risk industries are generally higher than those for standard accounts, and merchants should understand reserve requirements and monthly commitments before processing live payments.

Customer Reputation and Industry Standing

HighRiskPay.com has built a strong reputation among high risk merchants who rely on consistent support, reliable underwriting, and personal guidance throughout the payment processing journey. The company holds a high rating on Trustpilot, where it maintains a score of 4.7 out of 5 based on more than fifty verified reviews. This rating is supported by long term merchant relationships, positive feedback about customer service, and repeated references to responsive account representatives who help clients navigate both setup and ongoing account needs.

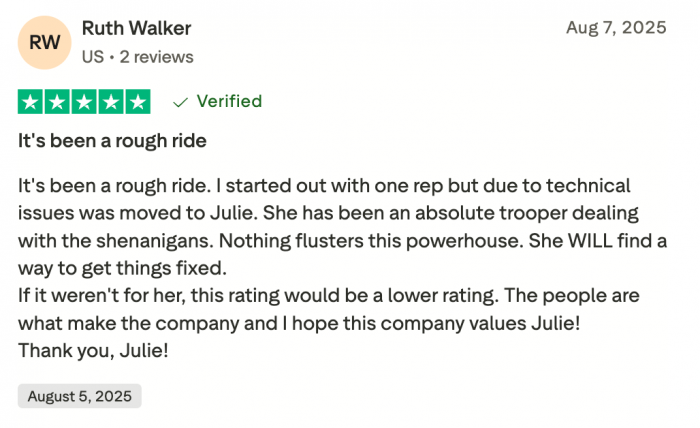

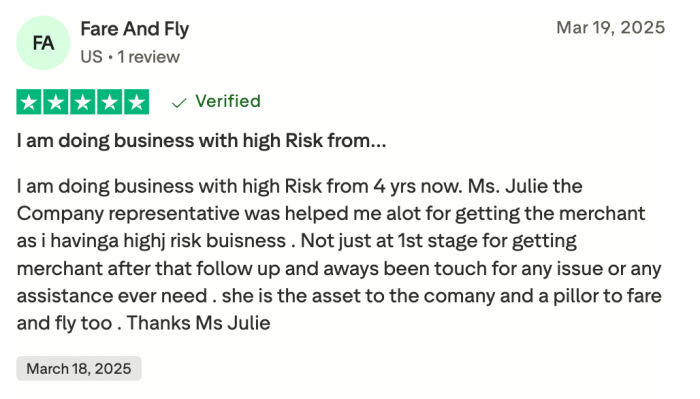

A recurring theme across the reviews is the value of individualized assistance. Many merchants state that their account managers, particularly representatives like Julie, Al, and Eyal, take an active role in helping them overcome approval hurdles, resolve technical issues, adjust account settings, and understand compliance requirements. Merchants often note that this level of personal involvement makes the service easier to use, especially for businesses that have been rejected by mainstream processors.

Below is a summary of common feedback patterns from verified Trustpilot reviewers.

Positive Experience Highlights

• Several merchants report that onboarding was smooth and faster than they expected. Some were approved after years of struggling with other payment processors.

• Many reviews mention strong communication from account representatives who check in regularly, follow up on outstanding items, and guide merchants through complicated situations.

• Long term users who have stayed with HighRiskPay.com for five to ten years describe the company as consistent, helpful, and dependable for ongoing chargeback support and account maintenance.

• Small businesses appreciate that they receive personalized attention rather than automated responses, which is rare in high risk payment processing.

Examples of Verified User Feedback

• A business owner described how a representative stepped in when a technical issue slowed onboarding and guided them through every stage until everything was functioning properly.

• Another merchant highlighted that after a few months of processing, the company helped them raise monthly limits, which allowed their business to scale more smoothly.

• Several reviews point out that HighRiskPay.com staff respond quickly to questions, often within minutes, which reassured new merchants who were unfamiliar with high risk compliance requirements.

• Multiple clients say they feel comfortable referring their friends or partners to the service because of the personal care they received.

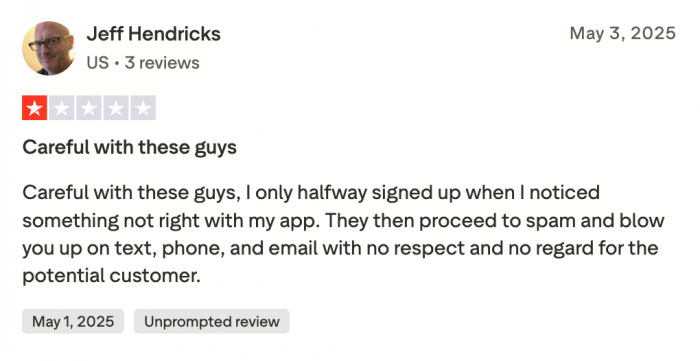

Neutral and Critical Feedback

Not all reviews are entirely positive, although the percentage of critical comments is very small. A minority of users noted that follow up communications felt too frequent or too persistent when they were still deciding whether to proceed with the application. HighRiskPay.com responded to these reviews directly, clarifying their contact practices and confirming that they stop communication once a potential client requests it. The responsiveness of the company to such feedback is viewed positively within the context of high risk processing, where customer outreach is often necessary to complete underwriting requirements.

Industry Standing and Long Term Credibility

Beyond individual reviews, HighRiskPay.com has maintained a stable position in the high risk merchant services market for many years. Merchants appreciate that the company works closely with banks that specialize in underwriting high risk industries. This consistency is valuable because it reduces the likelihood of unexpected account closures or disruptions in funding.

Many reviewers also highlight the benefit of having the same representative for multiple years. This helps merchants avoid repeating compliance explanations and ensures continuity as their business grows. For high risk merchants who often face shifting requirements from banks and acquiring partners, long term stability is a major advantage.

Overall Impression

The customer reputation of HighRiskPay.com shows that the company delivers reliable support, fast onboarding, and meaningful one on one assistance. The overwhelmingly positive Trustpilot reviews indicate that merchants feel supported both during the approval stage and throughout ongoing processing. The few negative comments relate mostly to communication frequency rather than operational issues. Taken together, these insights show that HighRiskPay.com maintains a strong industry presence backed by real user experiences and steady long term performance.

Final Verdict

The high risk merchant account at highriskpay.com is a practical solution for businesses that need immediate approval and access to credit card processing in industries that face strict scrutiny. Its strengths include fast turnaround, broad industry acceptance, and the absence of setup fees. Merchants should review the complete pricing outline before committing, but the service is a strong choice for those who want an accessible and reliable entry point into high risk payment processing.

Post Comments

Be the first to post comment!