What Is Inspira Financial? A Quick Primer

If you’ve ever had an old retirement account or a workplace health benefit moved without your say, chances are you’ve come across Inspira Financial. It’s the company that took over services once run by PayFlex and Millennium Trust.

Instead of focusing only on one area, Inspira now straddles both health and retirement benefits , handling everything from HSAs and FSAs to IRAs and COBRA. That sounds convenient, but the reality for users often feels less straightforward.

The Services on Offer

Inspira’s model is about bundling. Through its platform, it manages:

- Health accounts like HSAs, FSAs, and HRAs

- Retirement rollovers including automatic rollover IRAs

- Employer benefit programs such as COBRA administration and commuter benefits

The catch? Many people don’t actively choose Inspira. Instead, their accounts end up there after an employer moves funds or an old plan gets liquidated.

Getting Started: The Enrollment Puzzle

When you log in for the first time, the process can feel overwhelming. The portal and mobile app let you check balances, file claims, or request rollovers. On paper, it works like any other benefits platform.

But in practice, users on Reddit often describe login loops, repeated ID requests, and unclear instructions. So while onboarding should be quick, it often requires persistence.

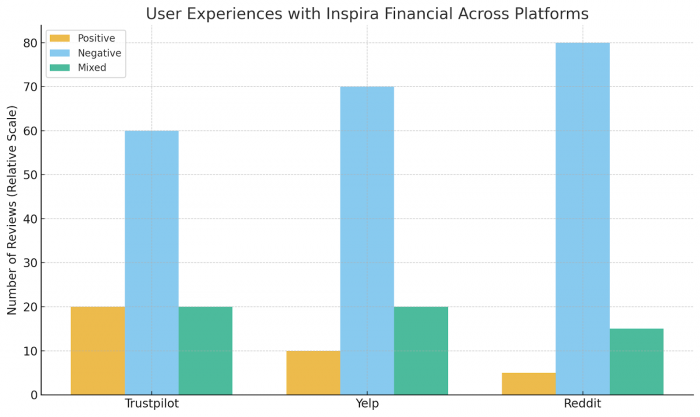

Real Experiences: Stories That Stand Out

This is where the Inspira story gets complicated. Some people get their claims paid smoothly or rollovers completed in a matter of weeks. Others feel trapped.

- On Yelp, reviewers complain of waiting months just to withdraw funds.

- On Trustpilot, many mention poor communication and unanswered emails.

- In one Reddit thread, a user described their account as effectively frozen — every attempt to submit documentation failed.

It’s not that every experience is negative, but the gap between smooth cases and horror stories is wide.

Why Employers Use Inspira

From a company’s perspective, Inspira offers one platform to manage multiple benefit categories. Aetna even integrates with Inspira to streamline member accounts. Employers like the promise of fewer vendors and consolidated reporting.

For employees, though, this consolidation can feel like bureaucracy — one more layer between them and their own money.

Common Frustrations Users Report

Let’s break down the most frequent pain points, drawn from reviews across Reddit, Yelp, BBB, and Trustpilot:

- Inaccessible accounts: Logins failing, portals down, or claims denied without explanation.

- Slow rollovers: Because Inspira isn’t ACAT-eligible, every transfer has to be manual, adding weeks.

- Unexpected charges: Closure and maintenance fees eating into small balances.

- Customer service bottlenecks: Tickets bouncing between agents or calls ending with no resolution.

When problems pile up, many resort to filing BBB complaints just to get a response.

What Works Well (When It Does)

To be fair, not everything is negative. Some reviewers say their claims were reimbursed quickly, or that they had helpful reps guiding them through rollovers. On Trustpilot’s second page, you’ll even find praise for specific employees who went above and beyond.

The takeaway? Success with Inspira often depends on persistence — and luck in who handles your case.

How to Protect Yourself if You’re Stuck With Inspira

If your account lands with Inspira, here are practical steps:

- Act fast: Log in and verify balances as soon as you’re notified.

- Keep records: Save screenshots, emails, and letters.

- Escalate smartly: If support stalls, file a BBB complaint or escalate through your employer’s HR department.

Know your options: If fees feel unfair or access is delayed, request a rollover to another custodian, even if it takes manual paperwork.

Final Thoughts: A Platform of Contradictions

Inspira Financial is pitched as a one-stop shop for health and retirement benefits. In reality, it often feels like a company people don’t choose but have to deal with.

For some, the experience is straightforward. For many others, it’s a fight for access, clarity, and basic service. If your funds end up here, patience and thorough documentation aren’t optional — they’re survival tools.

FAQ

How do I know if my retirement account has been moved to Inspira Financial?

You will usually receive a notice by mail or email from your old employer or plan administrator stating that your account has been transferred.

Can I refuse an automatic rollover into Inspira Financial?

No, once the employer initiates the rollover, the funds are moved. However, you can request a transfer out to another custodian afterward.

Does Inspira Financial charge fees for keeping an account?

Yes, some users report annual maintenance fees and closure fees, which can reduce small account balances.

How long does it take to withdraw money from Inspira Financial?

It can take several weeks, especially since Inspira is not ACAT-eligible and requires manual processing for transfers.

Is Inspira Financial a bank or a trust company?

Inspira Financial operates as a trust company and custodian, not a traditional bank.

What should I do if I cannot log into my Inspira Financial account?

You should contact customer service immediately, document all attempts, and escalate through the Better Business Bureau if the issue is not resolved.

Is my money safe with Inspira Financial?

Funds are typically held in custodial accounts, but poor customer service and security concerns mean you should monitor your account closely.

Post Comments

Be the first to post comment!

Table of Content

- What Is Inspira Financial? A Quick Primer

- The Services on Offer

- Getting Started: The Enrollment Puzzle

- Real Experiences: Stories That Stand Out

- Why Employers Use Inspira

- Common Frustrations Users Report

- What Works Well (When It Does)

- How to Protect Yourself if You’re Stuck With Inspira

- Final Thoughts: A Platform of Contradictions

- FAQ

- Comments

- Related Articles