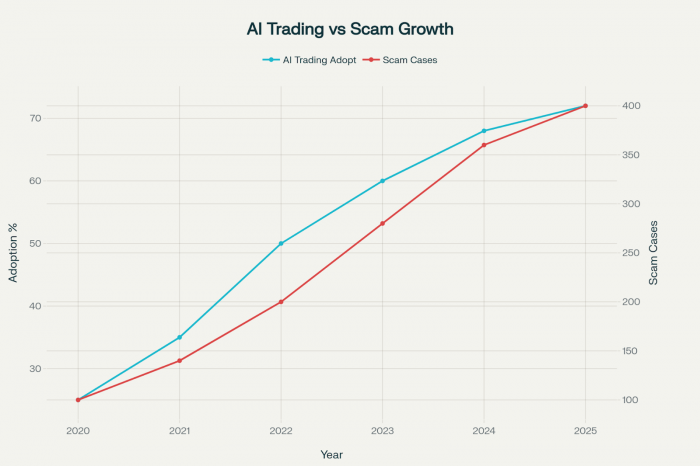

The AI Trading Boom, and a Surge in Risk

Artificial intelligence dominates trading conversations in 2025, but not always for the right reasons. With hundreds of new platforms claiming to “revolutionize market intelligence,” investors face one pressing question, Which AI tools are real, and which are rebranded scams posing as innovation?

By mid-2025, more than 72% of retail automated trades are powered by AI-assisted algorithms. But the California DFPI has simultaneously reported a 400% spike in AI-linked investment frauds since 2023.

And right in the middle of this frenzy stands CrossMarket AI, a self-proclaimed “universal cross-market intelligence” platform that’s raising eyebrows across trading circles.

What CrossMarket AI Claims to Be

According to its marketing site, CrossMarket AI positions itself as a “multi-market AI assistant” scanning crypto, forex, and equities for real-time profitable opportunities. Some review blogs loosely call it a ‘universal trading brain’, promising deep cross-asset analysis.

However, upon examination, the site lacks transparency on every major trust signal:

- No whitepaper or audit reports

- No founder identity or leadership info

- No API documentation, product demo, or GitHub code

Even the official website only contains login and signup portals, with zero information on governance or operations.

According to ScamAdviser, the domain is privately registered with proxy masking, while Scam Detector assigns a trust score of 8.4/100, labeling it “high-risk and potentially unsafe.”

User Reports Paint a Troubling Picture

User experiences across major forums and review sites confirm a consistent pattern: easy deposits, blocked withdrawals, and disappearing communication.

| Source | Key Findings | Trust Level |

| Trustpilot | Mixed claims, frequent reports of withdrawal delays | Low |

| Reddit & Trading Forums | Users call it “too good to be true”; withdrawal locks common | Very Low |

| Facebook Trading Groups | Reports of “guaranteed profit” ads & blocked funds | Low |

| Gridinsoft Security Blog | Detected potential phishing payloads on site | Unsafe |

| ScamAdviser | Domain anonymity, young registration age | Moderate Risk |

One Redditor wrote: “They let you deposit $100, but once you request a withdrawal, every contact vanishes.”

This behavior matches classic AI-branded Ponzi models: heavy onboarding incentives, hidden team, and unreachable support once funds are locked.

Regulatory Warnings and Global Context

The DFPI, FCA, and SEBI have each issued public alerts about a growing number of AI trading impersonator platforms.

- The DFPI (U.S.) warns that tools guaranteeing “AI-powered profits” without registration often involve deposit scams.

- The FCA (UK) and SEBI (India) highlight “AI arbitrage systems” running as fraud fronts for offshore entities.

In 2024, The Hindu reported that a Hyderabad trader lost ₹10 lakh to a similar AI-branded trading bot.

Regulators globally agree: if ownership, audit, and regulation are hidden, the risk is real.

Comparing CrossMarket AI to Legitimate Platforms

| Criteria | CrossMarket AI | eToro AI Insights | Coinbase Advanced | Interactive Brokers |

| Regulation | None | FCA, CySEC | FinCEN, FCA | SEC, FINRA |

| Transparency | Hidden ownership | Public team | Verified leadership | Audited & public filings |

| Withdrawal Policy | Repeated delays | Verified | Verified | Verified |

| AI Verification | None | Proprietary, documented | ML-backed risk modeling | Regulated ML analytics |

| Trust Level | High risk | Low risk | Low risk | Low risk |

Key Insight:

Legitimate AI trading tools do not guarantee returns. They emphasize analytics and insights, not blind profit promises.

For instance, eToro AI uses NLP to assess social sentiment in regulated environments, while Interactive Brokers’ AI runs under SEC supervision for predictive analysis.

By contrast, CrossMarket AI has no registration trail, no transparency, and no third-party

The Real Dangers, Beyond Money Loss

The biggest threat isn’t just losing funds, it’s identity theft.

Cyber-analysts at Gridinsoft Security Lab flagged the CrossMarket login portal for possible phishing payloads. Without HTTPS certification or encryption audits, any uploaded KYC documents or ID cards can be misused for fraud.

This converts a simple bad trade into a full data-theft scenario, including compromised identity, card info, and personal photos.

Safe and Verified Alternatives

Before investing in any AI-powered platform, verify licensing and audits. Here are safer, regulated options that actually use AI under compliance supervision:

- eToro – Licensed in the EU & U.S., uses AI for social-sentiment analysis and portfolio mirroring.

- Interactive Brokers – SEC-regulated, uses AI to refine portfolio optimization and trade timing.

- Coinbase Advanced – Employs ML algorithms for risk modeling, fully compliant under FinCEN.

Each of these maintains public company audits and transparent management, unlike anonymous setups such as CrossMarket AI.

Verdict: CrossMarket AI Matches Scam Patterns

Every factual indicator, domain data, scam detections, and user testimony, aligns with what regulators classify as a fraudulent AI trading entity.

- Hidden ownership and proxy domains

- Fabricated testimonials

- Deposit-first, withdrawal-blocked behavior

- Absence of audits or filings

Real AI innovation thrives on transparency, compliance, and reproducibility. CrossMarket AI fails every test, operating instead as a high-risk pseudo-platform designed to harvest deposits, not trade.

Final Reflection

Artificial intelligence is redefining global trading, but ethical innovation matters as much as intelligence itself.

The rise and exposure of CrossMarket AI highlight a hard truth: hype without honesty leads to harm.

In trading, as in life, the smartest move isn’t following the buzz, it’s following the facts.

People Also Ask (Quick Answers)

Q1. What does CrossMarket AI do?

It claims to offer cross-market AI trading but provides no proof of real automation or validated back-tests.

Q2. Is CrossMarket AI legit?

Based on scam-detector data and user feedback, it is not. The model resembles deposit-based fraud patterns documented by regulators.

Q3. Is CrossMarket AI regulated?

No, it holds no licensing from the FCA, DFPI, or SEBI.

Post Comments

Be the first to post comment!

Table of Content

- The AI Trading Boom, and a Surge in Risk

- What CrossMarket AI Claims to Be

- User Reports Paint a Troubling Picture

- Regulatory Warnings and Global Context

- Comparing CrossMarket AI to Legitimate Platforms

- The Real Dangers, Beyond Money Loss

- Safe and Verified Alternatives

- Verdict: CrossMarket AI Matches Scam Patterns

- Final Reflection

- People Also Ask (Quick Answers)

- Comments

- Related Articles