MyFastBroker.com has recently gained attention as a broker-comparison site claiming to help traders choose “the right online broker.” But with mixed reviews, unclear regulatory details, and multiple third-party warnings, many users are now asking:

Is MyFastBroker legit?

Does it recommend unregulated brokers?

Is it safe to rely on it for trading decisions?

This deep dive answers all of these questions by pulling insights from multiple review sources, safety audits, and industry standards.

What Is MyFastBroker.com?

MyFastBroker.com presents itself as an online broker comparison website.

It states that it helps users evaluate different types of financial brokers, forex, crypto, stock trading, options, CFD, insurance brokers, and more.

According to its homepage, the platform aims to:

- Provide broker comparison lists

- Offer educational trading guides

- Help beginners “choose the right broker”

- Share simplified reviews written in “plain language”

It does not position itself as a trading platform or brokerage service.

Instead, it operates more like a directory + blog + referral website.

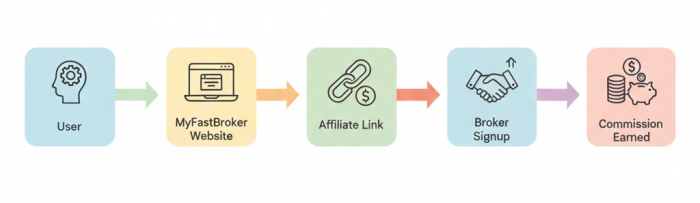

How MyFastBroker.com Claims to Work

The site claims to work through three primary functions:

Broker Review Pages

Each review includes general descriptions of the broker, its features, pros/cons, and user suitability.

Comparison Lists

Such as:

- Best Forex Brokers

- Best Crypto Brokers

- Best Stock Brokers

- Brokers for Beginners

- High-Leverage Brokers

Educational Content

Trading basics, account types, and risk explanations.

However, the quality and depth vary heavily, and most content appears surface-level, without verifiable data sources or in-depth regulatory checks.

Is MyFastBroker a Real Broker or Just a Comparison Website?

MyFastBroker is NOT a broker.

It does not:

- Handle client deposits

- Execute trades

- Provide trading accounts

- Offer regulated financial services

Instead, it acts as a broker referral site, directing users to third-party brokers.

This is essential to understand because the site itself cannot guarantee the safety or legitimacy of the brokers it recommends.

Who Owns MyFastBroker.com? Transparency, Team, and Credibility Check

This is one of the biggest concerns:

No founder details

No public profile, no corporate backing, no leadership page.

No registered company name displayed

A professional financial site normally provides:

- Legal address

- Company registration

- Regulatory affiliations

- Corporate transparency

MyFastBroker lacks all of these.

Content appears generic & possibly AI-assembled

Pages share a uniform style, often lacking citations.

Credibility Red Flag:

A legitimate financial comparison platform typically shows editorial teams, analysts, compliance officers, and has a traceable online history.

MyFastBroker has none.

Is MyFastBroker.com Legit or a Scam?

Based on available evidence:

It is NOT an outright phishing site

The domain loads properly, SSL is active, and no malware alerts appear.

It does NOT meet industry standards for legitimate financial comparison platforms

It provides no disclosures about:

- Data sources

- How brokers are ranked

- Whether rankings are influenced by affiliate fees

- No regulatory oversight or checks

This means any broker recommendation is purely subjective, not vetted.

Verdict:

MyFastBroker is not a confirmed scam,

but it is also NOT a verifiably legitimate financial authority.

It falls into the category of “use with caution.”

MyFastBroker Safety Check: Regulation, Licensing and Compliance Review

Since the site is not a broker, it is not regulated.

However, the brokers it recommends should be regulated.

But here is the issue:

Independent reviews found that

MyFastBroker frequently lists brokers without confirming their regulatory status.

No mention of:

- FCA (UK)

- ASIC (Australia)

- CySEC (Europe)

- NFA/CFTC (USA)

No compliance page or risk disclosure

Legitimate financial sites usually include:

- Risk warnings

- Regulatory disclaimers

- Conflict-of-interest statements

MyFastBroker does not provide these.

Does MyFastBroker Work With Regulated or Unregulated Brokers?

Based on multiple external reviews:

Many brokers listed appear to be offshore or lightly regulated

This increases the risk of:

- Withdrawal problems

- Poor consumer protection

- Lack of fund segregation

- No compensation schemes

Some brokers appear on “watchlist” sites

This implies questionable credibility.

None of the listings show direct verification of regulatory licenses

You MUST verify every broker directly through:

- FCA Register

- ASIC Connect

- CySEC Directory

- FINRA/NFA check

Never rely on MyFastBroker’s descriptions alone.

What Brokers Does MyFastBroker Recommend? Are They Safe?

The site does not clearly list all brokers, but uses posts like:

“Best Forex Brokers”

“Fastest Brokers”

“Best Brokers for Beginners”

Many appear to be offshore entities.

Safety Evaluation:

- No regulatory documentation

- No verification links

- No withdrawal safety assessment

- No user review aggregation

- No trust score indicators

This lack of transparency is a major risk factor for new traders.

Affiliate Model Analysis: Does MyFastBroker Earn Commissions From Referrals?

Nearly all comparison sites do — but MyFastBroker does not disclose this.

This is a problem because:

It creates bias

Brokers may appear “recommended” simply because they pay affiliate fees.

No conflict-of-interest disclaimer

Legitimate comparison portals must disclose:

“We may earn a commission if you sign up through our link.”

MyFastBroker does not.

Financial bias, not user benefit

This means the platform might promote high-paying brokers instead of safe ones.

Red Flags Identified in Independent Reviews

Across FastBull, AccountingLads, JewelsGalaxy, and others, these red flags appear again and again:

- No regulatory license

- No founder identity

- No corporate registered address

- No customer support channels

- No transparency on ranking process

- Possible affiliate-driven listings

- Promotes offshore brokers

- Thin or automated content patterns

- Generic articles across multiple unrelated domains

All of these raise credibility concerns.

MyFastBroker.com Pros and Cons (Based on Real Findings)

Pros

- Clean & simple beginner-friendly layout

- Covers many broker categories

- Offers basic educational material

- Acts as a research starting point

Cons

- No regulation

- No audit trail

- No founder information

- No verification of broker safety

- High-potential affiliate bias

- Unverified claims

- Risk of leading users to unsafe brokers

- Lacks depth and data-rich analysis

Alternatives to MyFastBroker.com You Should Consider

These are reputable, transparent financial comparison sites:

Investopedia Broker Reviews

Industry-standard analysis.

NerdWallet Investing

Well-researched, verified comparisons.

BrokerChooser.com

Checks regulation, safety, and fees.

Finder.com Trading Platforms

Verified reviews with pros/cons & regulatory checks.

If safety is your priority, these platforms are dramatically more trustworthy.

Final Verdict: Is MyFastBroker Worth Your Trust?

MyFastBroker.com is not a scam,

but it is also not a verified, authoritative financial resource.

It is best described as:

A low-transparency broker referral site with affiliate-driven motives and limited verification.

Use it only as a starting point, never as a final decision-maker for choosing where to invest your money.

If you decide to explore any brokers listed, always verify regulation independently through official financial authorities.

FAQ

Is MyFastBroker regulated?

No, it is not a broker and holds no regulatory license.

Does MyFastBroker handle my money?

No, it redirects users to third-party brokers.

Can I trust the brokers listed on MyFastBroker?

Not without independent regulatory checks. Some may be offshore.

Is MyFastBroker recommended for beginners?

No. It lacks enough transparency and safety indicators.

Post Comments

Be the first to post comment!

Table of Content

- What Is MyFastBroker.com?

- Who Owns MyFastBroker.com? Transparency, Team, and Credibility Check

- Is MyFastBroker.com Legit or a Scam?

- MyFastBroker Safety Check: Regulation, Licensing and Compliance Review

- Alternatives to MyFastBroker.com You Should Consider

- Final Verdict: Is MyFastBroker Worth Your Trust?

- FAQ

- Comments

- Related Articles