Operating an eatery demands substantial skills because it requires juggling team administration with labor time records and responding to employee payment needs as well as tax obligations. The process requires dedicated time while employees use different tools leading to possible mistakes during the execution.

The team management system and payroll solution Toast Payroll operates specifically to serve restaurant businesses. The system maintains all employee data within a single Toast point-of-sale (POS) platform since it functions directly with this system across the payroll process. The combination of time tracking functionality as well as automated tax filing features onboarding automation and tip management services enables Toast Payroll to minimize both worker payment errors and staff scheduling administration for restaurant owners.

Overview

Toast Payroll is a payroll and HR solution designed specifically for the restaurant industry. It helps small and mid-sized restaurants manage employee pay, track hours, and stay compliant with tax rules. Toast Payroll works directly with Toast POS, so everything stays in one system. Toast Payroll is part of Toast’s restaurant software suite. It helps restaurant owners and managers handle tasks such as:

- Running payroll

- Filing taxes

- Tracking employee time

- Managing benefits and onboarding

Key Features of Toast Payroll

1. Integrated Time Tracking

- Tracks hours directly from Toast POS

- Auto-calculates regular, overtime, and holiday pay

- Reduces mistakes caused by manual data entry

2. Automatic Tax Filing

- Calculates, files, and pays federal, state, and local payroll taxes

- Helps avoid penalties and late fees

- Keeps you updated on tax changes

3. Employee Self-Service Portal

- Employees can view pay stubs, W-2s, and time-off balances

- Reduces HR workload by letting team members manage personal info

- Offers mobile access

4. Scheduling and Tip Management

- Build and publish schedules

- Assign roles and shifts easily

- Track and distribute tips fairly

5. New Hire Onboarding

- Create onboarding checklists

- Collect I-9 and W-4 forms digitally

- Ensure compliance from day one

Benefits for Restaurant Owners

- Toast Payroll is built for the unique needs of restaurants. Some of its main benefits include:

- Saves time by automating payroll and taxes

- Avoids fines with built-in compliance tools

- Improves accuracy with real-time time tracking

- Boosts team satisfaction with mobile tools and clear tip records

- Keeps everything in one place, from POS to payroll

Pricing and Subscription Plans

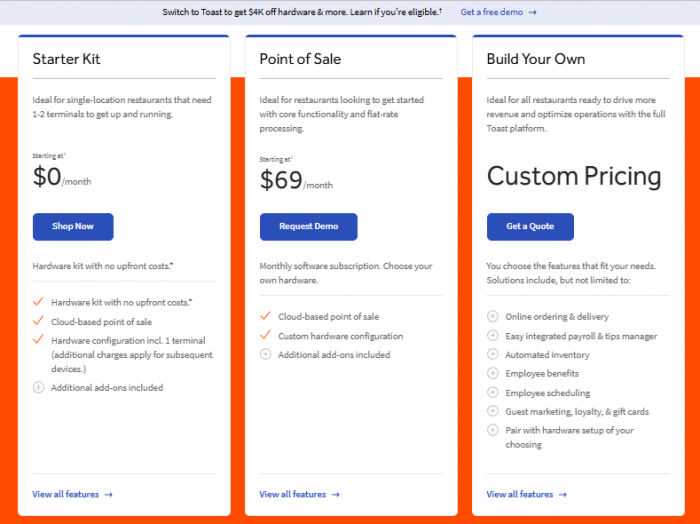

1. Starter Kit – $0/month

Ideal for: Small restaurants with 1–2 terminals

Includes:

- No upfront hardware cost

- Cloud-based point of sale

- 1 terminal configuration (extra charges for more devices)

- Basic add-ons included

2. Point of Sale – Starting at $69/month

Ideal for: Restaurants needing core functionality with flat-rate software pricing

Includes:

- Monthly software subscription

- Cloud-based point of sale

- Custom hardware configuration

- Add-ons available

3. Build Your Own – Custom Pricing

Ideal for: Growing restaurants looking for advanced features

Includes options for:

- Online ordering and delivery

- Payroll and tips manager

- Automated Inventory

- Employee benefits and scheduling

- Loyalty programs and gift cards

- Hardware setup of your choice

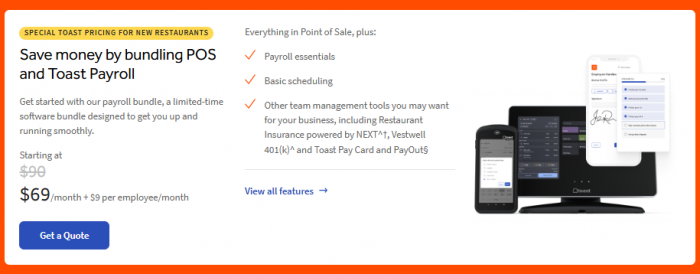

Toast POS + Payroll Bundle for New Restaurants

Toast offers a special bundle for new restaurants that includes both its Point of Sale (POS) system and Payroll services. This helps you manage sales and employee payments in one place.

Pricing

- $69/month base fee

- +$9/month per employee

- Regular price: $99/month

What’s Included

- Payroll essentials – Run payroll, file taxes, and pay employees

- Basic scheduling – Create and manage staff schedules

- Team tools – Access to insurance, 401(k), and digital pay options

Who Should Use Toast Payroll?

- Toast Payroll is best for:

- Independent restaurants

- Small restaurant chains

- Quick-service or full-service restaurants

- Businesses already using Toast POS

How to Get Started

- Starting with Toast Payroll is simple:

- Request a demo from Toast’s website

- Talk to a Toast advisor to get a quote

- Set up your employee data and bank details

- Start running payroll and tracking hours from your POS

Conclusion

If you run a restaurant and need a simple way to manage payroll, scheduling, and taxes, Toast Payroll could be a helpful option. It is designed for restaurants, so its features are built to match common tasks in the food service industry.

Since it connects with the Toast POS system, there’s no need to enter data in multiple places. This helps reduce mistakes and saves time. Employees can also check their hours and pay details more easily. Pricing varies based on the features you choose. Toast Payroll includes tools for tax filing, onboarding new staff, and managing tips, which may support daily team operations.

Post Comments

Be the first to post comment!