Most people don’t install follower-boosting apps with a long-term plan in mind. They do it out of curiosity, frustration, or urgency. A reel underperforms. A competitor’s account suddenly spikes. A YouTube video promises “free followers in minutes.” Somewhere in that moment, TopFollow enters the picture.

On the surface, TopFollow presents itself as a simple Android app designed to help Instagram users “promote their account” using hashtags and in-app tools. That positioning is visible directly on its Google Play listing. But the real story of TopFollow isn’t found in its feature description. It’s found in how people experience it after installation.

This article looks at TopFollow as it operates in real user environments, what it connects to, what it changes, and what trade-offs users often discover only later.

The Role TopFollow Plays in the Instagram Growth Landscape

Instagram growth tools broadly fall into three informal groups. There are analytics and scheduling tools that work within platform rules. There are content-assistance tools that help with captions, timing, or hashtags. And then there’s a third group: engagement exchange tools, where visibility is “earned” through reciprocal actions.

TopFollow belongs squarely in that third group.

Although the app highlights hashtag usage on its Play Store page, external app directories and user walkthroughs describe a familiar model: users earn internal credits or coins by completing tasks and then spend those credits to receive followers or likes. This approach is also reflected in overviews like Softonic’s explanation of TopFollow’s mechanics, where growth is framed as fast but conditional rather than organic.

That distinction matters. Organic growth is slow but cumulative. Exchange-based growth is fast but fragile.

The First Moments After Installation (Why Reactions Are So Mixed)

For users who install TopFollow intentionally and understand what it is, the experience often feels smooth at first. The app loads quickly, the interface is simple, and actions produce visible results. Numbers move. That immediate feedback is satisfying, especially for newer creators.

But a significant portion of users encounter TopFollow in a very different emotional state. They install it after:

- searching for emergency growth solutions

- watching a video promising rapid results

- feeling pressure to “catch up” with competitors

In those cases, TopFollow isn’t perceived as a tool, it’s perceived as a lifeline. When outcomes later disappoint or accounts face restrictions, frustration turns into distrust. This emotional contrast explains why reviews swing so sharply between “works fine” and “ruined my account.”

The app doesn’t create that tension, but it operates inside it.

Minimal Design, Maximum Assumptions

TopFollow’s interface is intentionally stripped down. There are no long explanations, no onboarding education, and very few warnings about downstream effects. The app assumes users already understand:

- how Instagram evaluates engagement

- what third-party interaction patterns look like

- where platform boundaries are

For experienced marketers, that assumption is acceptable. For casual users, it’s risky.

What’s notably missing are strong guardrails, things like clear explanations of engagement quality, warnings about policy risk, or visible indicators separating “real reach” from “exchange activity.” The result is speed and ease, but also ambiguity.

Popularity Signals vs. Quality Signals

From a distribution standpoint, TopFollow looks successful. On Google Play, it shows over 1 crore downloads, a 4.3-star rating, and frequent updates, including one as recent as January 2026. These signals build confidence at first glance.

However, popularity doesn’t equal sustainability.

When you look deeper into reviews, especially longer, detailed ones, a pattern appears. Users often describe:

- followers that don’t interact

- engagement spikes followed by drops

- reach that declines even as follower count rises

This gap between surface metrics and meaningful engagement is the core weakness of exchange-based growth. The algorithm notices it long before creators do.

Privacy and Account Exposure Considerations

One section users rarely read carefully is Google Play’s Data Safety disclosure. For TopFollow, this section indicates that the app may collect and share device or other identifiers, encrypts data in transit, and states that data cannot be deleted once collected.

Individually, none of these points prove malicious intent. Collectively, they raise reasonable questions:

- What long-term data footprint does the app create?

- What happens if the service is discontinued or breached?

- How tightly is this data linked to Instagram identity?

When combined with the nature of engagement-exchange apps, these questions become more than theoretical.

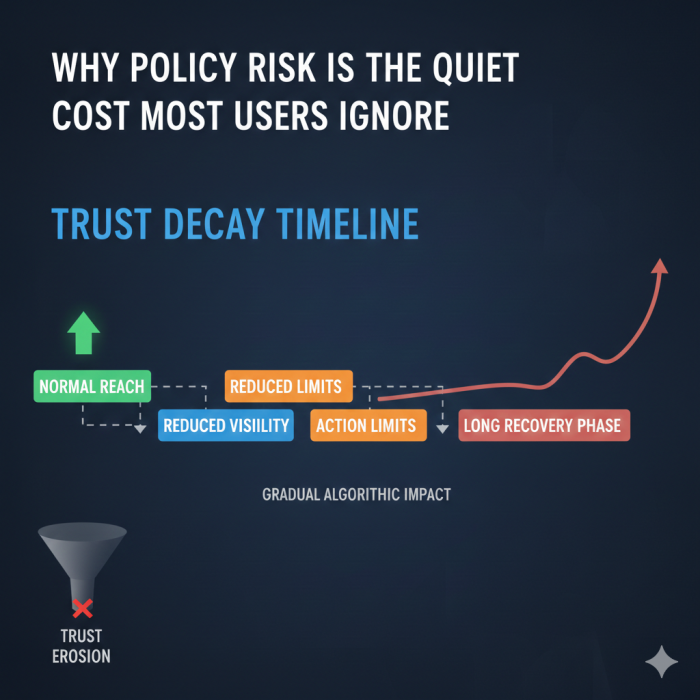

Why Policy Risk Is the Quiet Cost Most Users Ignore

Instagram rarely penalizes accounts immediately. Instead, it adjusts trust signals slowly, reducing reach, limiting actions, or flagging behavior as suspicious.

Third-party growth tools don’t usually trigger bans overnight. They trigger doubt. And once an account enters a lower-trust category, recovery is slow.

App directories like Softonic openly warn that tools promising fast followers can violate Instagram’s terms or lead to spam detection. That doesn’t mean every user will be punished. It means the risk is uneven and unpredictable, exactly the kind brands and serious creators try to avoid.

The APK Ecosystem Adds Another Layer of Risk

Outside the Play Store, TopFollow-branded APK files circulate across multiple sites. Some present themselves as “official,” others compare modified versions or bundle TopFollow with unrelated apps.

The issue here isn’t Android sideloading itself. It’s verification. APK mirrors can introduce:

- altered code

- outdated builds

- injected trackers or ads

Even sites that warn about fake versions acknowledge that clones exist. For users who care about account safety, that alone is a strong reason to avoid off-store downloads entirely.

Warning Signals That Suggest the App Is Doing More Harm Than Good

Problems rarely announce themselves clearly. They appear as patterns.

One early sign is engagement mismatch. Followers increase, but story views, saves, and comments stay flat. That usually means the audience isn’t real, or isn’t interested.

Another signal is instability. Likes disappear, follower counts fluctuate, or reach drops despite consistent posting. This often indicates filtering rather than growth.

More serious signs include:

- repeated “suspicious activity” alerts

- temporary blocks on liking or following

- forced password resets

The clearest red flag is discomfort around credentials. Any app that requests Instagram login details outside official flows or pushes repeated authentication prompts should be exited immediately.

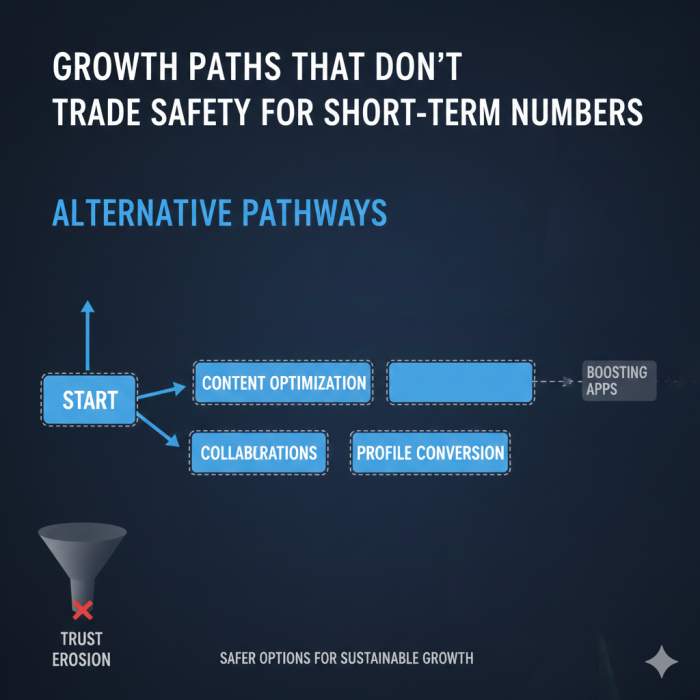

Growth Paths That Don’t Trade Safety for Short-Term Numbers

The assumption that growth apps are the only alternative to “slow growth” is false.

Accounts that shift focus to retention-driven reels, clearer profile positioning, and consistent posting windows often outperform boosted accounts over time. Micro-collaborations with similar-size creators produce higher-quality followers than exchange loops ever will.

Another overlooked factor is profile conversion. Many accounts lose potential followers simply because their bio, highlights, or pinned posts don’t explain why someone should follow. Fixing that converts existing reach into real growth without touching third-party tools.

The difference between these approaches and follower-boosting apps is alignment. One works with the platform. The other works around it.

Putting It All Together: A Practical Scorecard

Scoring is subjective, but context matters. On a 1–10 scale:

| Area | Score | Context |

| Visibility & reach promise | 8 | Large install base and fast feedback |

| Transparency | 5 | Simple claims, limited explanation of mechanics |

| Privacy comfort | 4 | Device ID collection, no data deletion |

| Account safety | 3 | Exchange-based patterns increase policy risk |

| Long-term engagement value | 4 | Numbers often don’t convert into community |

Overall: 4.8 / 10

TopFollow delivers what it hints at, movement in numbers, but at a cost many users don’t calculate upfront.

Final Perspective

TopFollow exists because the desire for fast growth exists. It satisfies curiosity and impatience effectively. What it doesn’t offer is durability.

For low-stakes experimentation, it can feel harmless. For creators, brands, or businesses that depend on trust, reach, and credibility, the margin for error is thin.

TopFollow isn’t dangerous by design.

But it operates in a space where misunderstanding the rules is often more damaging than breaking them.

That’s the trade-off users should understand before tapping install.

Post Comments

Be the first to post comment!

Table of Content

- The Role TopFollow Plays in the Instagram Growth Landscape

- The First Moments After Installation (Why Reactions Are So Mixed)

- Minimal Design, Maximum Assumptions

- Popularity Signals vs. Quality Signals

- Why Policy Risk Is the Quiet Cost Most Users Ignore

- Warning Signals That Suggest the App Is Doing More Harm Than Good

- Putting It All Together: A Practical Scorecard

- Final Perspective

- Comments

- Related Articles