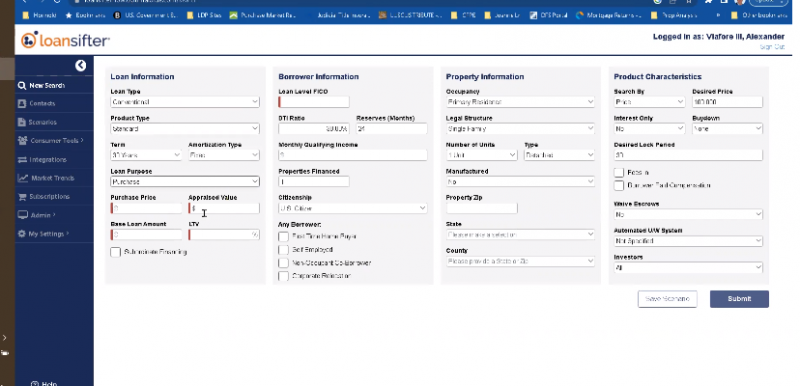

Loansifter is like a supercharged search engine for mortgage brokers. It helps you quickly find the best home loan deals from over 120 lenders all in one place .Instead of checking each lender's site one by one, Loansifter gives you a dashboard that shows them all at once, with filters to narrow it down by what your client qualifies for.

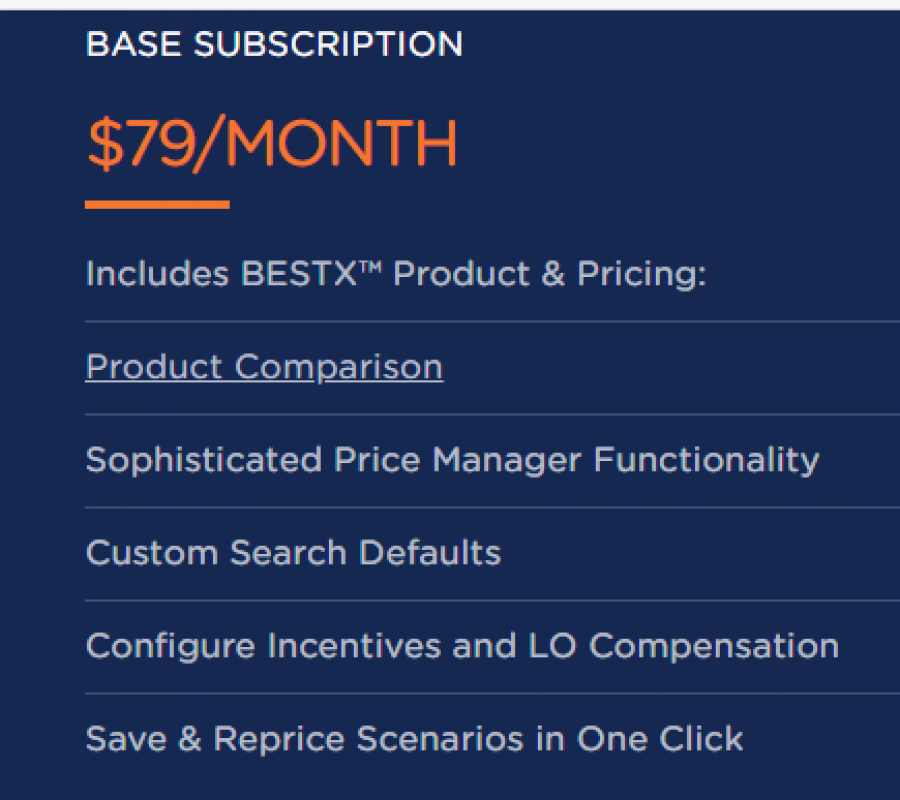

| Plan / Feature | What you get | Monthly Cost (USD) |

|---|---|---|

| Base subscription (1 user) | The core Loansifter tool: product & pricing engine (BESTX™), search defaults, ability to save & re-price scenarios, configure compensation etc. | US$ 79 / month |

| Add‑on: LOS Integration | If you want your system (like Encompass, Calyx Point etc.) to integrate with this tool so you don’t have to enter data twice. | + US$ 20 / month |

| Add‑on: Quick Quote & similar extra features | Features like “Quick Quote” (website quoting for customers), perhaps “Long Form” quoting etc. | Starting at US$ 200 / month for those extras. |

Wide loan product variety for fast, accurate comparisons.

Intuitive pricing engine makes scenario and rate searches easy.

Real-time investor rate updates; competitive edge.

Seamless integration with LOS systems, reduces manual errors.

Not all lenders participate, so coverage can vary.

Training required to use more complex scenario functions.

Loansifter Features

Loansifter Reviews

Loansifter Software

*Price last updated on Nov 13, 2025. Visit www2.optimalblue.com's pricing page for the latest pricing.