Shore Funding Solutions is a financial services provider that offers fast, flexible funding options to small and medium businesses. They specialize in business term loans, equipment financing, working capital, and merchant advances, aiming to provide capital quickly (often within 24 hours) with minimal paperwork, even for businesses with less-than-ideal credit.

| Aspect | Shore Funding Solutions | Merchant Cash Advance / MCA Firms | Traditional Bank Loans / SBA | Equipment Financing Specialists |

|---|---|---|---|---|

| Speed | Fast (24–48h) | Very fast | Slower (weeks to months) | Moderate (days to weeks) |

| Flexibility / Repayment | Multiple models, options, remittances linked to sales | Flexible payments tied to sales | Fixed schedule, more rigid | Often flexible for the asset life |

| Qualification Barriers | Moderate (needs some history, revenue) | Lower threshold but higher fees | High barrier (credit, collateral) | Moderate — depends on asset valuation |

| Cost / Fees | Flat-fee or fixed rate models — risk-based | High cost / fees (often criticized) | Lower rates but stricter terms | Cost tied to asset depreciation, interest rates |

| Transparency | Variable based on deal | Often opaque / aggressive terms | Higher transparency, regulated | Transparent in many standard lease arrangements |

You can get the money you need in as little as 24 hours.

They approve loans at twice the industry average, making it easier to get funding.

The application process is quick and requires minimal paperwork.

Loans for higher-risk businesses may come with higher fees or interest rates.

They mainly serve businesses in the U.S. and Canada, which isn’t helpful for businesses elsewhere

Shore Funding Solutions

Shore Funding Solutions Home Page

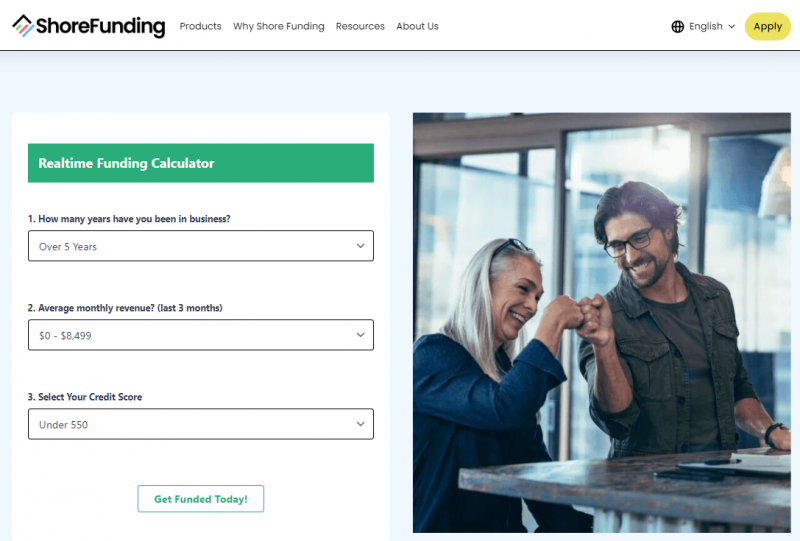

Realtime Funding Calculator

Pricing yet to be updated!